When working with high volume low margin items a small difference in broker fees can make a large difference in profits. The theoretical lowest possible broker fee is 0.1875% which requires standings of 10 with both the faction and the corporation that owns the station. On Jita (by far the largest market hub in the game) which I'm going to use as an example that's Caldari State (faction) and Caldari Navy (corporation).

But how many players actually have 10 and 10 (or even close) standings? Probably not very many. It's probably better to consider 0.25% (which requires 9 and 9 standings) as the lowest possible broker fee.

Paying the broker fee twice (once for the buy order and once for the sell order) it costs 0.50% in broker fees + 0.75% tax = 1.25% total cost to buy and resell anything. Actually a bit less than that assuming you buy for a bit less than you sell for.

The vast majority of competitors aren't going to have anywhere near those standings or quite that low a broker fee anyhow. A somewhat higher and far more realistically achievable broker fee of 0.30% is possible with standings of 3 Caldari State and 8 Caldari Navy.

That comes out to 0.75% tax + 2 x 0.30% broker fees for a total cost of 1.35%. Only 0.10% higher than with the much harder to get 9 and 9 standings.

With no standings (0 and 0) you pay 0.75% tax + 2 x 0.75% broker fees for a total cost of 2.25%.

I'm going to use those total cost numbers, 1.25%, 1.35% and 2.25%, throughout the rest of this article.

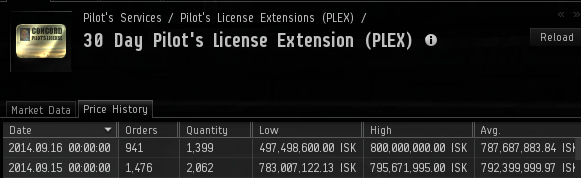

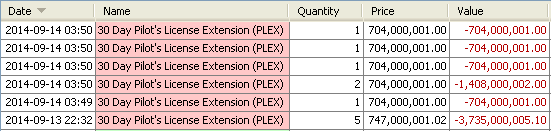

The following is a current real example of how broker fees affect profits on a high priced, high volume, low margin item (PLEX) on the busy Jita market.

The above screenshot was taken just after 7:00 am server time on the 24th of Sept 2014.

The lowest sell order at the time was 785 million and the highest buy order 781 million. Obviously there's no profit to be made buying and reselling PLEX with only 4 million markup. In fact you'd be taking a loss of over 5 million even with perfect standings (10 and 10) for the lowest theoretically possible taxes and fees.

However there are only 6 PLEX in the lowest sell order. The next lowest is 10 million higher and there are plenty more available incrementally higher. It's more realistic to consider the sell price to be 795 million. That's a markup of 14 million which is still unprofitable with 2.25% taxes and fees but is profitable with reduced broker fees lowering the total cost.

Working with a 14 mil markup on a 781 mil buy price for a 795 mil sell price

At 2.25% you'd pay 17.8875 mil taxes and fees and lose 3.8875 mil

At 1.35% you'd pay 10.7325 mil taxes and fees and make 3.2675 mil

At 1.25% you'd pay 9.9375 mil taxes fees and make 4.0625 mil

That's a 24% increase in profit going from 3.2675 mil at 1.35% to 4.0675 mil at 1.25%.

However, even at 1.25% cost it's still a very slim profit margin of less than half of 1 percent. You'd have to sell a lot of PLEX to make very much total profit at such a low margin. But it still is profitable so you don't have to back off when someone tries to dominate a market and bully everyone else out with low margins.

Then again, PLEX are a high priced (currently in the 750-800 million range), high volume (moving 2500+ per day on Jita) item. If you can buy and sell 100 a day (4% of Jita daily volume) for a profit of 4 million each that'd be 400 million a day and far more than that when margins are higher.

That's with a very small markup though and a really tight margin even for PLEX.

Assuming you aren't overpaying on buy orders you can usually buy and resell PLEX within a reasonable amount of time with a less aggressive 20 mil markup.

With a 20 mil markup on a 780 mil buy price for a 800 mil sell price

At 2.25% taxes and fees would be 18 mil for a profit of 2 mil per PLEX

At 1.35% taxes and fees would be 10.7325 mil for a profit of 9.2675 mil per PLEX

At 1.25% taxes and fees would be 9.9375 mil for a profit of 10.0625 mil per PLEX

Moving 100 a day that'd be

200 million profit

926.75 million profit

1.0625 billion profit

Moving 100 a day that'd be

200 million profit

926.75 million profit

1.0625 billion profit

Note with the higher markup going from 1.35% to 1.25% only increases profit by about 8.5% rather than the 24% we saw with a 14 mil markup.